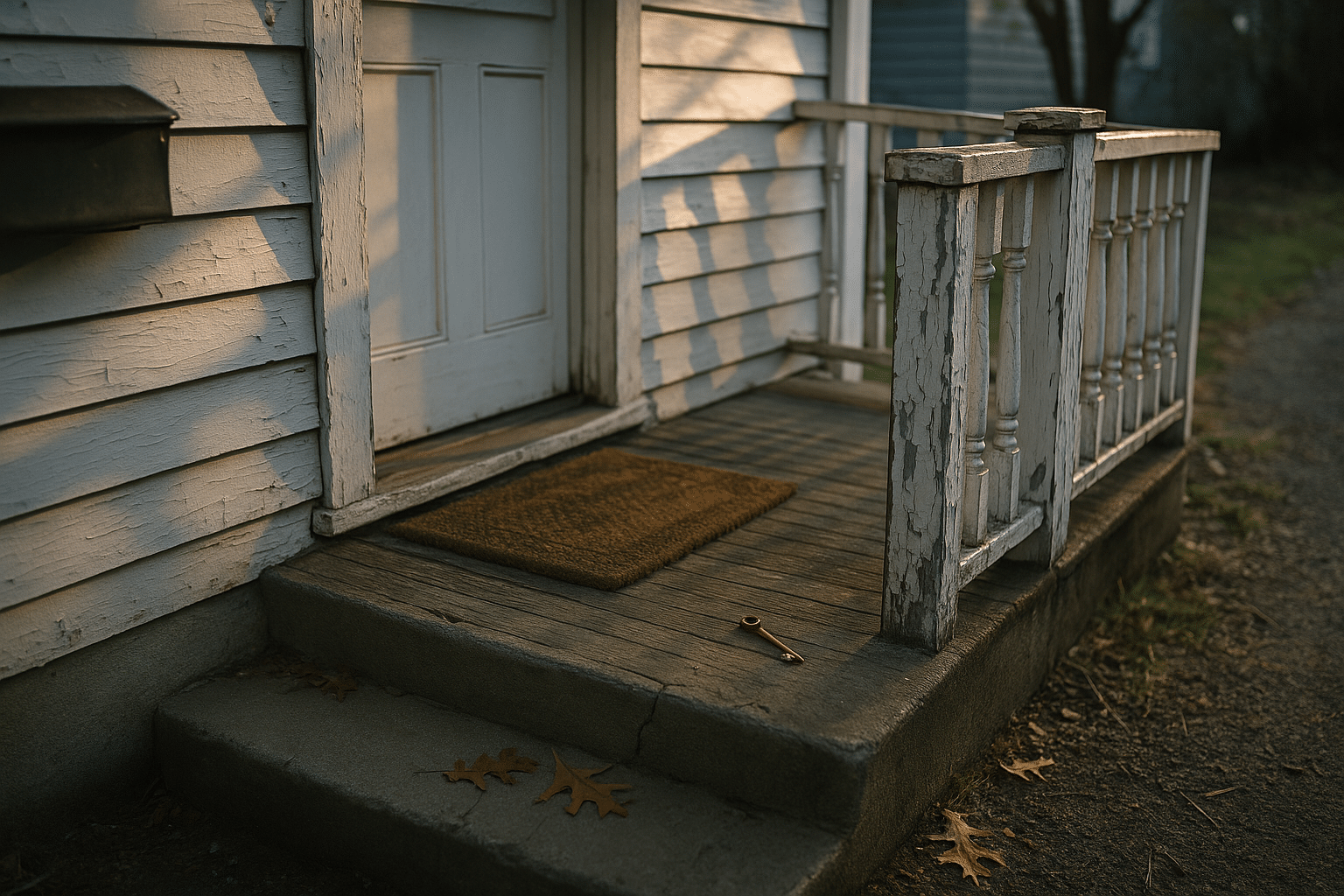

Rent-to-own: A low-stress home buying experience

How Rent-to-Own Works: From Lease to Keys

Rent-to-own blends a traditional lease with the option to buy the same property later at a pre-agreed price. For many households, that mix creates breathing room: you can move in now, test the home and neighborhood, and use time to improve credit, accumulate a down payment, and get comfortable with the monthly budget. In housing markets shaped by tight inventory and stricter lending, this pathway can relieve pressure without forcing you to pause your dream of ownership for years.

Two common formats shape most agreements. In a lease-option, you lease the property and purchase only if you choose to; you pay an “option consideration” up front—often 1% to 5% of the home’s price—to secure the right to buy later, typically within 12 to 36 months. In a lease-purchase, you commit to buying at the end of the lease; missing that deadline can trigger penalties. Many contracts include a rent credit—often 10% to 25% of monthly rent—applied toward the purchase price or closing costs if you buy on time. The purchase price is usually locked in on day one, sometimes with an annual adjustment known as an escalator.

Why it matters now: lending standards can be tougher for self-employed workers, recent graduates, and anyone rebuilding credit. Meanwhile, saving a conventional down payment takes time; even a modest 5% on a $300,000 home is $15,000, not including closing costs or reserves. A rent-to-own setup allows steady monthly progress with clear milestones, while you live in the home you plan to own.

Outline of this guide to keep you oriented:

– Who benefits and when it makes sense: profiles and scenarios that fit.

– The numbers: option fees, rent credits, price paths, and comparisons.

– Risks and protections: red flags and due diligence steps.

– Conclusion and timeline: a practical, low-stress roadmap to the finish line.

Think of rent-to-own as a dress rehearsal—same stage, same lighting, lower stakes. You learn the home’s quirks through real living, not a ten-minute showing. If the foundation of any smart purchase is information plus time, rent-to-own can provide both, so long as every obligation is spelled out in writing and you keep your eyes open to the fine print.

Who Benefits and When It Makes Sense

Rent-to-own is not a universal solution, but it shines for specific situations where time and flexibility solve the core problem. Consider first-time buyers who lack a large down payment. Industry surveys consistently show that saving for upfront costs and improving credit are the biggest barriers to entry. Rent-to-own helps convert part of your monthly housing cost into a future asset through rent credits, while you inhabit the home you intend to own. For households facing credit hurdles, the breathing room can be pivotal: on-time rent payments strengthen your financial routine while you work on reducing credit card balances and adding positive account history.

It can also serve self-employed workers and freelancers who need several months of documented income to satisfy a future mortgage underwriter. Instead of delaying a move, you lease now and continue building the paper trail—tax filings, bank statements, and profit-and-loss records—so that, when the option window arrives, your file is review-ready. People relocating to a new area benefit too: a lease period lets you test commute routes, schools, noise levels, and even seasonal quirks like winter road conditions or summer traffic.

There are also strategic reasons to consider rent-to-own in changing markets. If interest rates are currently higher than your target budget can comfortably handle, you use the lease period to monitor rate movements and shop lenders. If inventory is thin, locking a home early spares you from competitive bidding. At the same time, you accept that home prices can rise or fall; the pre-agreed price protects you from bidding wars but may feel expensive if the local market cools.

Common profiles that align well with rent-to-own include:

– First-time buyers with steady income but limited savings.

– Credit rebuilders who need 12–24 months for score improvements.

– Self-employed or contract workers formalizing income documentation.

– New residents wanting to “live-test” a neighborhood before committing.

– Households anticipating a near-term windfall or salary growth that improves affordability.

In short, rent-to-own makes sense when time is the missing ingredient and commitment risk is managed. It is less suitable for buyers who already qualify comfortably for a mortgage or for those who expect to move again soon. The more intentional you are about your timeline and financial milestones, the more this path can feel like a calm, well-marked trail rather than a scramble up a cliff.

The Numbers: Payments, Option Fees, and Price Paths

Understanding the math is crucial, because clarity turns stress into strategy. Suppose a home’s current price is $300,000. You and the owner agree to an option period of 24 months and a future price of $318,000, reflecting a 3% annual escalator. You pay a 3% option consideration—$9,000—credited toward the purchase if you buy on time. Monthly rent is $2,200, with a 20% rent credit ($440) accruing each month toward purchase funds or closing costs. Over 24 months, your rent credits add up to $10,560. If you proceed to buy, you bring both the option consideration and rent credits to the settlement—together $19,560—which can help cover down payment and closing expenses.

How does that compare with renting elsewhere while saving? If you rented a similar home for $2,000 and saved $1,000 per month in a high-yield account for 24 months, you’d amass $24,000 plus interest. That may exceed the rent-to-own credits, but you’d risk the target home selling to someone else or price growth outpacing your savings rate. With rent-to-own, you secure today’s opportunity and convert a portion of monthly housing spend into future equity, at the cost of some flexibility.

Key variables you should pin down with precision:

– Option consideration: typical range 1%–5% of price; clarify whether any part is refundable if things fall through.

– Rent credit: percentage or fixed amount; confirm how it’s tracked and applied at closing.

– Purchase price formula: fixed number or indexed with an escalator; include dates.

– Repair responsibilities: who handles routine maintenance vs. major systems.

– Deadlines: option exercise date, closing window, and grace periods.

What if the market shifts? If values jump, your pre-set price can be advantageous; if values dip, you might feel locked into an above-market number. One way to balance this is to negotiate a modest escalator or an appraisal clause that allows reconsideration if the appraised value falls substantially below the contract price. Be mindful that lenders will underwrite against appraised value; if the appraisal is lower than your agreed price, plan to bring the difference in cash or renegotiate. The math is not just dollars—it’s about aligning risk, time, and optionality with your household’s reality.

Risks, Red Flags, and How to Protect Yourself

Rent-to-own can be empowering, but only with guardrails. The chief risk is forfeiture: if you miss the option deadline or default on the lease, you can lose the option consideration and accumulated credits. Another hazard is overpaying for future value; an aggressive escalator can outstrip the neighborhood’s trajectory. Maintenance duties are another tripwire—some contracts push major repairs onto tenants before ownership, which can strain your budget. Finally, title problems or unpaid liens can complicate your closing, even if you did everything right.

Here’s a practical defensive playbook:

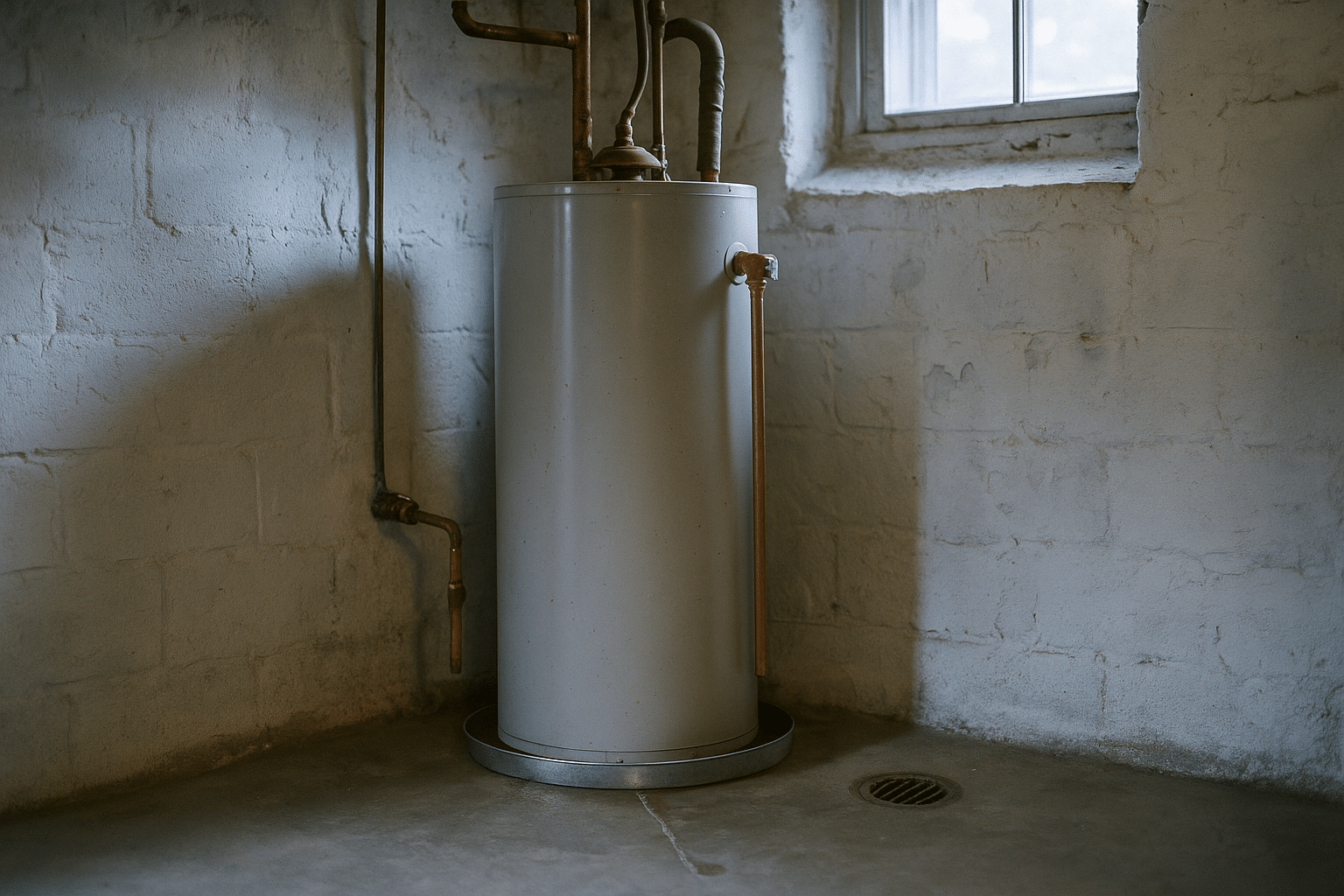

– Inspect early and thoroughly: arrange a professional home inspection before signing, plus specialized checks for roof, HVAC, plumbing, and foundation if recommended.

– Verify title and liens: order a preliminary title report; confirm the owner’s mortgage is current and taxes and association dues are paid.

– Put every dollar on paper: require a ledger that tracks rent credits monthly, and stipulate the escrow holder responsible for the option funds.

– Define repairs by threshold: for example, tenant handles items under a set dollar amount; owner covers major systems and structural defects.

– Protect your timeline: add calendar reminders for option and notice dates, and negotiate a short grace period in case of emergency.

– Keep receipts: save proof of every repair you fund and every credit applied.

On the financial side, map your credit-building plan to the option window. Reduce credit card utilization, automate on-time payments, and avoid opening new debt that could change your debt-to-income ratio. Meet with a mortgage professional early to estimate a target loan amount and monthly payment, then pressure-test it against your budget. If your plan hinges on an income increase or bonus, set a conservative backup route so a delayed raise doesn’t derail the ending.

A few red flags warrant a pause: vague promises about “guaranteed approval,” refusal to allow inspections, a purchase price that far exceeds comparable sales, or a contract that forbids a mortgage contingency. The goal is a clear, fair deal, not a mystery. When the paperwork matches the pitch—and your numbers match your comfort—you can proceed with confidence and keep the experience calm and predictable.

Conclusion: Your Step-by-Step Timeline for a Low-Stress Journey

Use this timeline as your compass, tailoring dates to your market and comfort level. Month 0–1: education and pre-checks. Study sample contracts, interview local professionals, and pull your credit reports. Create a “buy box” with price range, neighborhoods, and must-have features. Month 1–2: property search and due diligence. As soon as you find a candidate, schedule inspections, request a preliminary title report, and model the math with realistic rent credits and a conservative escalator. Negotiate repairs and responsibilities while you still have leverage.

Month 2–3: finalize the agreement. Have a qualified professional review the contract. Set up a simple ledger to track credits and store documents. Clarify where the option consideration will be held and how you’ll obtain monthly statements. Month 3–18: build momentum. Automate rent, savings transfers, and credit card payments. Assemble your mortgage file steadily: pay stubs, bank statements, tax returns, and letters of explanation for any credit hiccups. Schedule seasonal checkups on the property—gutter cleaning, HVAC service—to avoid surprises and to strengthen your bargaining position if a major system fails.

Month 18–21: mortgage readiness. Reconnect with your lender options to refresh pre-qualification. Compare fixed and adjustable scenarios, model payments at a range of rates, and check current appraisal dynamics in your area. If your agreement allows, consider a pre-appraisal to gauge value relative to the contract price. Month 21–24: exercise the option and close. Send notice in writing by the contract deadline, order the appraisal, lock your rate when the numbers work, and complete underwriting. Keep a closing checklist with funds-to-close, insurance, and utility transfers.

Quick checklist to make it all feel manageable:

– Calendar the option notice date and set two backup reminders.

– Maintain a single digital folder for the agreement, monthly ledgers, and receipts.

– Track your credit score quarterly and your savings monthly.

– Rehearse your closing funds at least 60 days early to avoid last-minute scrambles.

– Walk the home 48 hours before settlement to confirm condition.

In summary, rent-to-own can turn a high-pressure sprint into a measured stride. You secure a home you like, convert part of your rent into tomorrow’s equity, and let time help you qualify for financing. With a transparent contract, steady habits, and a realistic timeline, you can move from first tour to final keys with fewer surprises and more calm—exactly the kind of low-stress experience that makes homeownership feel not only possible, but well within reach.